this post was submitted on 12 Nov 2024

440 points (99.1% liked)

Greentext

4430 readers

1003 users here now

This is a place to share greentexts and witness the confounding life of Anon. If you're new to the Greentext community, think of it as a sort of zoo with Anon as the main attraction.

Be warned:

- Anon is often crazy.

- Anon is often depressed.

- Anon frequently shares thoughts that are immature, offensive, or incomprehensible.

If you find yourself getting angry (or god forbid, agreeing) with something Anon has said, you might be doing it wrong.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

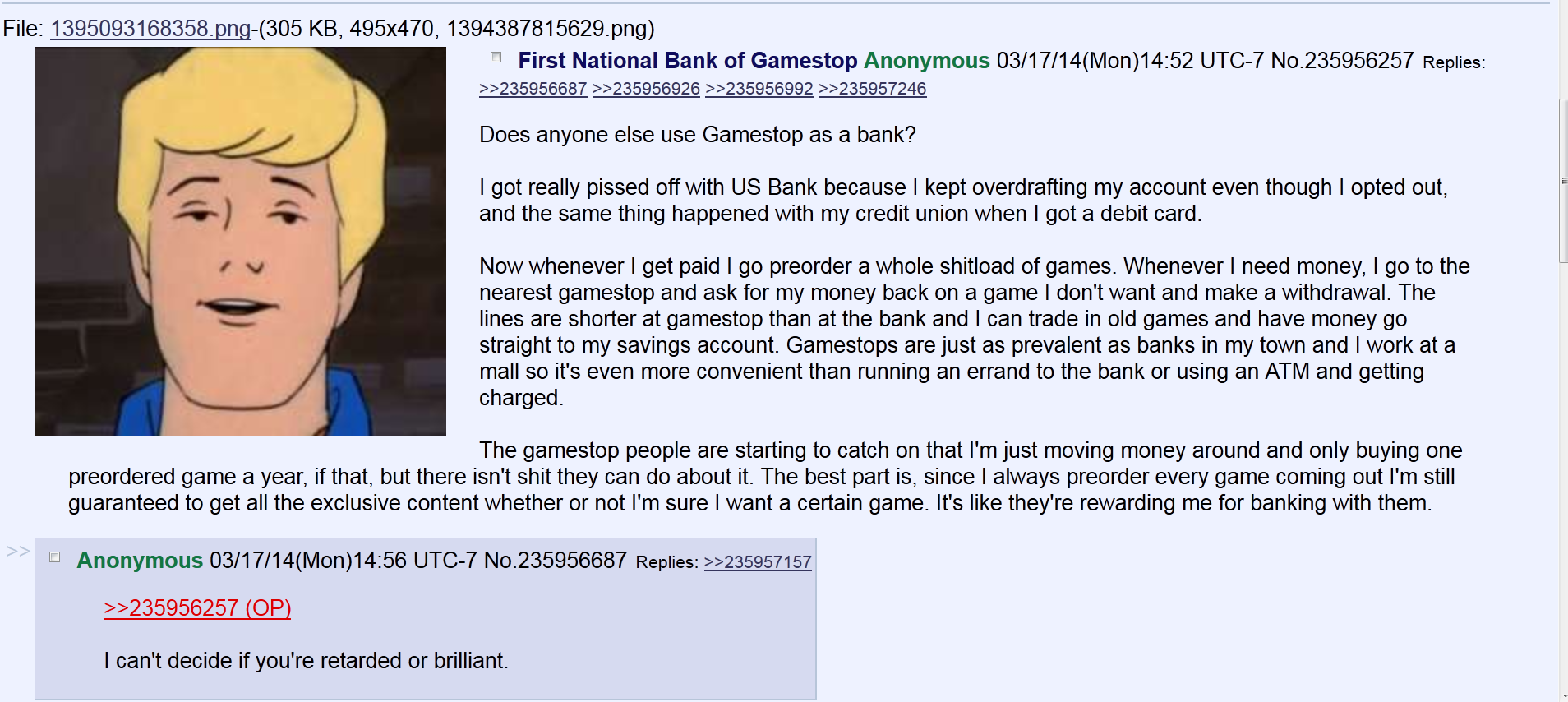

"I kept overdrafting my account even though I opted out"

Is this some SovCit shit where they think "opting out" of the terms of service for their bank account is an option?

No, there's a US law now where they have to allow you to opt out of overdraft "protection". They just decline the transaction but don't charge you any fees.

If only they didn't charge fees. My bank charges an insufficient funds fee that's conveniently the same amount as the overdraft protection fee. So my options are eat the fee and get my stuff, or eat the fee and not get my stuff.

I'm not entirely sure this is legal, but I was told directly by a representative that these were my options. It's quite literally a poor tax.

Just curious. Why not just get a different bank or credit union?

Mentioned in another post, but I don't qualify for many credit unions beyond my local one that I currently use. I've used a few different bank options, but none of them have really been any better, and usually worse.

Your current one as in, your credit union is the one charging you these "insufficient fund" fees?

I'm admittedly not educated in the law of banks and credit unions, but I have a feeling they aren't meant to be doing that.. not that the little man like you or I could do much about it 🤷🏾♂️

Yeah, like I said, not entirely sure it's legal, but that's the boat I'm in. The other banks did the same shit, charged me more, and offered me worse rates on loans. At least this one spits on it before going in.

That's rough buddy. Time to get a fake identity and open an account in a different state with stricter banking laws