this post was submitted on 11 Apr 2024

478 points (96.5% liked)

Memes

50016 readers

380 users here now

Rules:

- Be civil and nice.

- Try not to excessively repost, as a rule of thumb, wait at least 2 months to do it if you have to.

founded 6 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

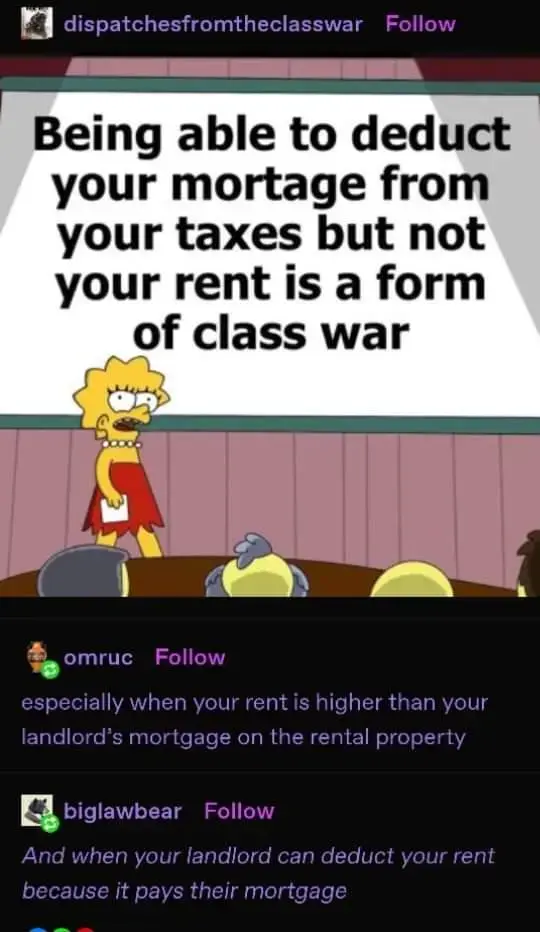

In the US you can deduct the mortgage interest, which is even more of a benefit for the wealthy than the mortgage as a whole would be since the deduction decreases the longer someone stays in a home.

Social security being a flat percentage with a cap is also a form of class war.

Not sure I get why social security being flat with a cap benefits one class over the other.

Sure, once I meet the max contribution then my withholding goes down and my take home increases. But anything in excess of the max contribution doesn't affect social security payouts after retirement

if you put in more, you get out more, and if you're capped in your contributions then you're also capped in your withdrawals.

Is it a paternalistic program? Sure, it's essentially a forced retirement plan. Its implementation isn't perfect, but I'm not sure I'd call it class warfare.

When wealth is concentrated because wages don't increase with productivity, the wealthy are paying less than their fair share of taxes to society with a flat percentage that has a cap.

Look at it this way, if there is 1 million dollars taxed at 3% and there is no cap it doesn't matter who gets what, $30k total is collected. If there is a 100k cap and one person takes in 500k and 10 people take in 50k in income apiece then only $9k is collected and the one taking in 500k is putting in the same amount as everyone else. They are also less in need for social security retirement savings because they can easily squirrel away more in savings.

Yes, the taxation is regressive, but the benefits are progressive. E.g.,

( https://en.m.wikipedia.org/wiki/Social_Security_(United_States) )

It's certainly not a perfect system, but personally I think it has some merit. And it's by far not the worst aspect of USA tax structure (in my opinion).