this post was submitted on 17 Sep 2024

1486 points (96.8% liked)

Memes

45727 readers

1025 users here now

Rules:

- Be civil and nice.

- Try not to excessively repost, as a rule of thumb, wait at least 2 months to do it if you have to.

founded 5 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

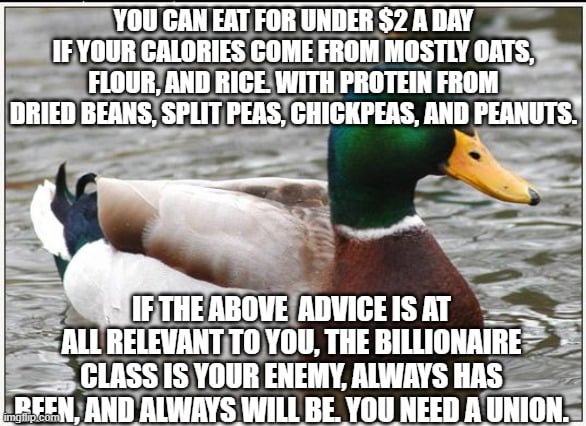

To be clear, if you're at all concerned about maintaining a food budget, even if it's $500/week the billionaire class is still your enemy.

To be clear, the billionaire class is your enemy

To be clear, the 100 million class is also your enemy

Any billionaire can lose 90% of their wealth and have above 100 million left.

Many can lose 99% and have above 100 million left.

Some can lose 99% and still be billionaires.

The 100 millionaire will still have a million or more left after losing 99%, but that's not "live like hogs in the fat house forever" money at least. It's just "I don't have to worry if I lose my job" money.

A hundredbillionaire can lose 99% of their money and not make any perceptible changes in their lifestyle.

I propose the following:

Gap individual wealth at 50000x the national median annual income. Max wealth anyone in the US could have is, at present, under 2 billion. Other countries will vary, but generally it's plenty enough to motivate people to innovate, but nobody gets to be Bezos or Musk wealthy. Yachts should count towards this wealth gap, at a depreciation rate of 5% a year off the build cost. Primary residence doesn't count unless it's also used for generating income. You get to have one car, regardless of price, that doesn't get counted towards it, and the other ones count at market value. So you can have your classic car that appreciates in price, and a daily driver - without having to worry about the classic car's effect on your wealth limit.

Side effect is that now suddenly rich people near the gap will be a lot more interested in paying better wages to the working class. Why? Because then they'd get to keep more of their money. And to raise the median efficiently, you need to be raising wages for the poorest among us first and foremost.

Holy cow, they can lose 90% of their wealth and still be above 100 mil. The math checks out, but my gosh, how rich are they?!

It's ridiculous.

Numbers are funny, anyway. Nvidia CEO Jensen Huang's net worth is closer to yours and mine than it is to Elon Musk (Forbes list currently placing them at ~100 bill and ~250 bill respectively). But that's only in absolute terms. In reality, Jensen's got like 8 or 9 orders of magnitude more wealth than I do depending on how far into the month we are, and on the same order of magnitude as Musk.

Either one losing 99% of their wealth would still be above a billion.

Well, at least now I feel that Musks tweet about liberty and being oppressed and blah are even more funny than ever. He has literally the wealth to buy countries, if he would wish to.

In general; I think even 2 billion is too much. Nobody needs that much money.

At best; I think no one should be able to have more than about 500 Million. You get one house, and one car for each adult family member if you're married with non-adult kids. Adult kids don't add uncounted vehicles; they have their own limit. Anything that is seaworthy or airworthy counts as about as much "Wealth" as you initially spent on it minus a reasonable depreciation rate yearly as determined by the market, so no buying a thing and having it lose 30% of it's value the moment you drive it off the lot after buying it.

Additionally; to block too many shenanigans; wealth added by any property that is bought sticks; 3 years at minimum. This prevents people from storing too much excess in property and shell-gaming it. A company you own or have stake in cannot lend (in a long term) or gift you property in excess of 1% to 10% the wealth limit. (Depending on what the thing is). Companies may also not hold property or money in lieu of an individual personally; everything the company owns must have a global company function; and not personally benefit one or more people only. (Basically no executive-only or owner-only Jets; everyone from the tiniest manager on up should have access to it if there's a business reason for it)

Oh I agree that even 2 billion is too much, but my reasoning is that proponents of capitalism often make the claim that capitalism drives innovation (you try to fill some market niche in order to get rich) so if they are right, then 2 billion should be enough that this still works.

I had yachts depreciating to zero in my example because it's estimated that you have to spend about 10% of its' purchase price annually anyway, so anyone keeping a 20 year old yacht around is going to be spending a lot of money on it that will fuel other parts of the economy.